Enabling Escrow Trading in Poland, a Freshly Monetized Market

Designing solutions in payments domain at Vinted as a product designer in a high-growth startup, enabling escrow-based payments in the Polish market for millions.

- Role: Product Designer

- Timeline: 2019 - 2020

- Platform: Web & Mobile

Executive summary

In 2019, Vinted prepared to launch escrow-based payments in Poland, a market that had previously relied on manual transactions. This required collecting users’ full legal names to meet payment compliance requirements, data that most Polish users had never been asked to provide.

Over a two-month period, a phased, low-friction data collection strategy was designed and launched across new and existing users. The solution resulted in a significant increase in full-name submissions and confirmations, with no measurable negative impact on sign-up conversion. By the end of the grace period, the majority of active traders were enabled to use escrow services, allowing Poland to transition into a monetized market with minimal disruption.

Context & Problem

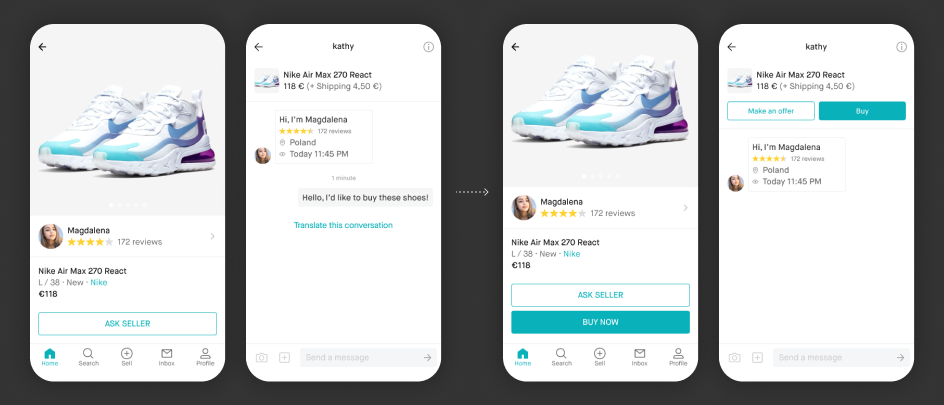

Before monetization, Polish users could trade only through manual agreements, handling payments and shipping independently and relying entirely on mutual trust. With the introduction of escrow services, Vinted’s payment provider was legally required to know users’ full legal names before enabling transactions.

However:

- Polish users were not previously required to provide full names

- Many existing users had incomplete, incorrect, or unverified names

- Some users relied on social media sign-ups where names were not necessarily real

- Without compliant data, users would be blocked from trading after launch

The timeline was tight, and a failed rollout risked excluding a large portion of the user base from escrow-enabled trade.

Goals & Objectives

The primary objective was to enable escrow-based trading for as many users as possible while minimizing friction and negative impact on user behavior.

Key goals included:

- Collect compliant full names from both new and existing users

- Maintaining sign-up and trading conversion rates

- Preserving user trust around privacy and data security

- Supporting a time-bound, legally constrained launch

I led the design of the full-name collection solution, working closely with product, engineering, analytics, research, legal, and communications teams.

Process & Solution

A Lean UX approach was applied, focusing on iterative design, early validation, and data-driven decision-making.

User and problem analysis

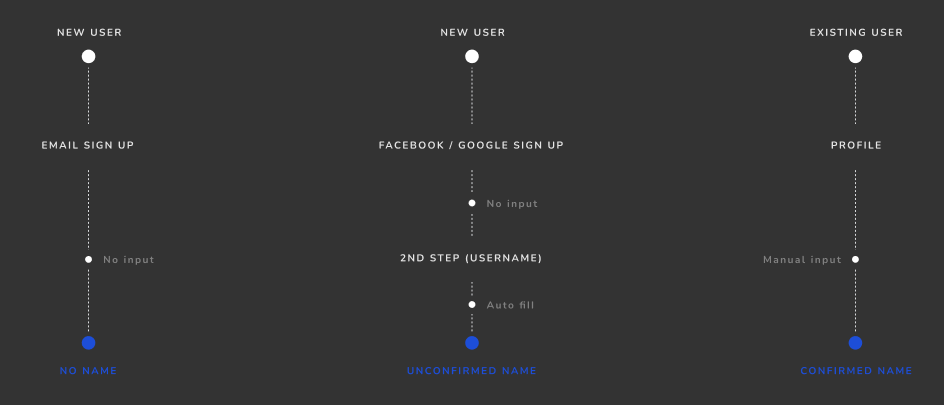

- Segmented users by activity level, trading role, and name status

- Identified critical risk groups, such as active sellers without compliant names

- Mapped existing user flows to uncover friction points

Hypothesis-driven strategy

- New users would be more willing to share personal data during sign-up

- Existing users would comply if given transparency, value context, and time

- Phased communication would reduce backlash and resistance

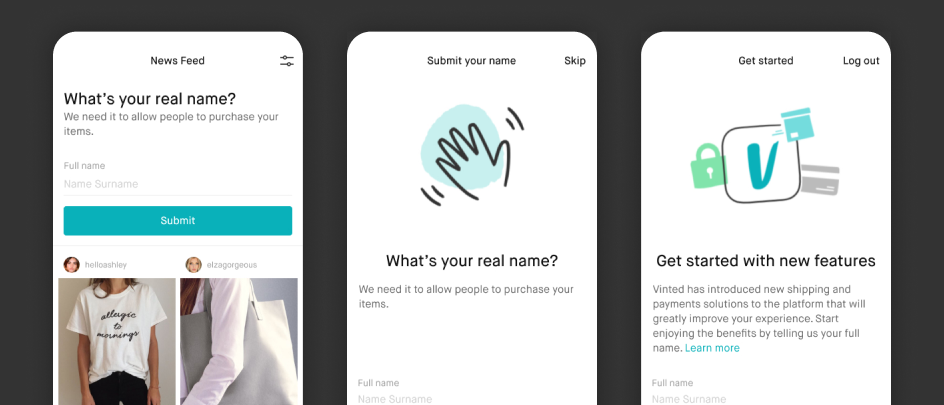

Solutions for new users

- Added a Full name field to email sign-up forms with clear privacy reassurance

- Introduced a confirmation step for Facebook and Google sign-ups, allowing users to correct imported names

- Tested changes incrementally with close monitoring of registration metrics

Solutions for existing users

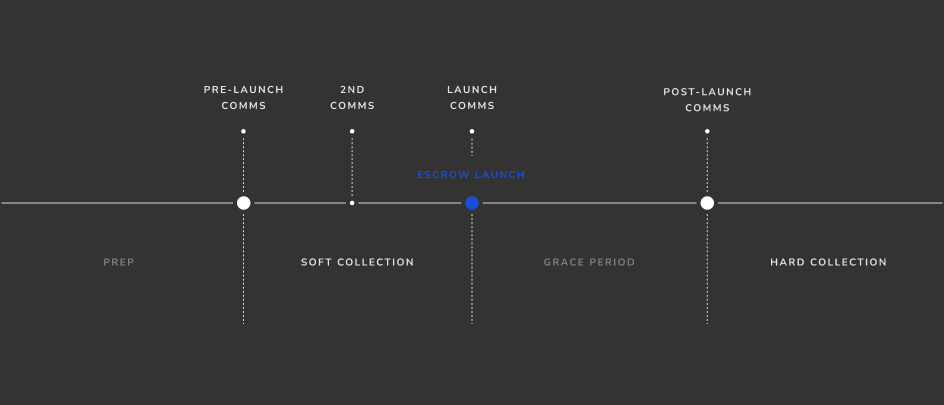

- Designed a multi-phase rollout

- Pre-launch communication explaining the upcoming escrow service and its value

- Soft collection via non-disruptive banners and flexible modal prompts

- Grace period collection during first escrow transactions

- Hard collection as a last resort, temporarily hiding items until compliance

- Collaborated with communications to align product UI and messaging

- Conducted guerrilla usability testing to validate clarity and non-disruptiveness

Delivery and monitoring

- Ensured clear design handoff and close collaboration with developers

- Tracked conversion, submission, and confirmation rates throughout rollout

- Adjusted copy and accessibility based on early feedback

Outcome & impact

The phased approach successfully transitioned Poland into a monetized market with escrow-based trading.

Key outcomes:

- Significant increase in full-name submissions and confirmations

- No significant drop in sign-up or engagement metrics

- Majority of active traders enabled for escrow by the end of the grace period

- Minimal user backlash due to transparent communication and gradual enforcement

The project met its primary goal of enabling secure, compliant trade at scale while preserving user trust and platform stability.